Florida Asset Protection & Estate Planning Law Firm

We help protect what you’ve earned.

We’ve been advising people about asset protection and estate planning for over 30 years.

About the Firm

Alper Law is a third-generation law firm near Orlando, Florida.

Jon Alper and Gideon Alper help clients with asset protection, estate planning, real estate transfers, and adoption.

Decades of Experience

Our attorneys have over 40 years of combined legal experience.

Individualized Attention

You will work directly with Jon Alper or Gideon Alper. We do not delegate work to junior associates.

Virtual Services

All services are available virtually. Consultations can be scheduled by phone and Zoom.

Flat Fees

Most services are priced as flat fees. You know how much you will pay in advance.

Our Attorneys

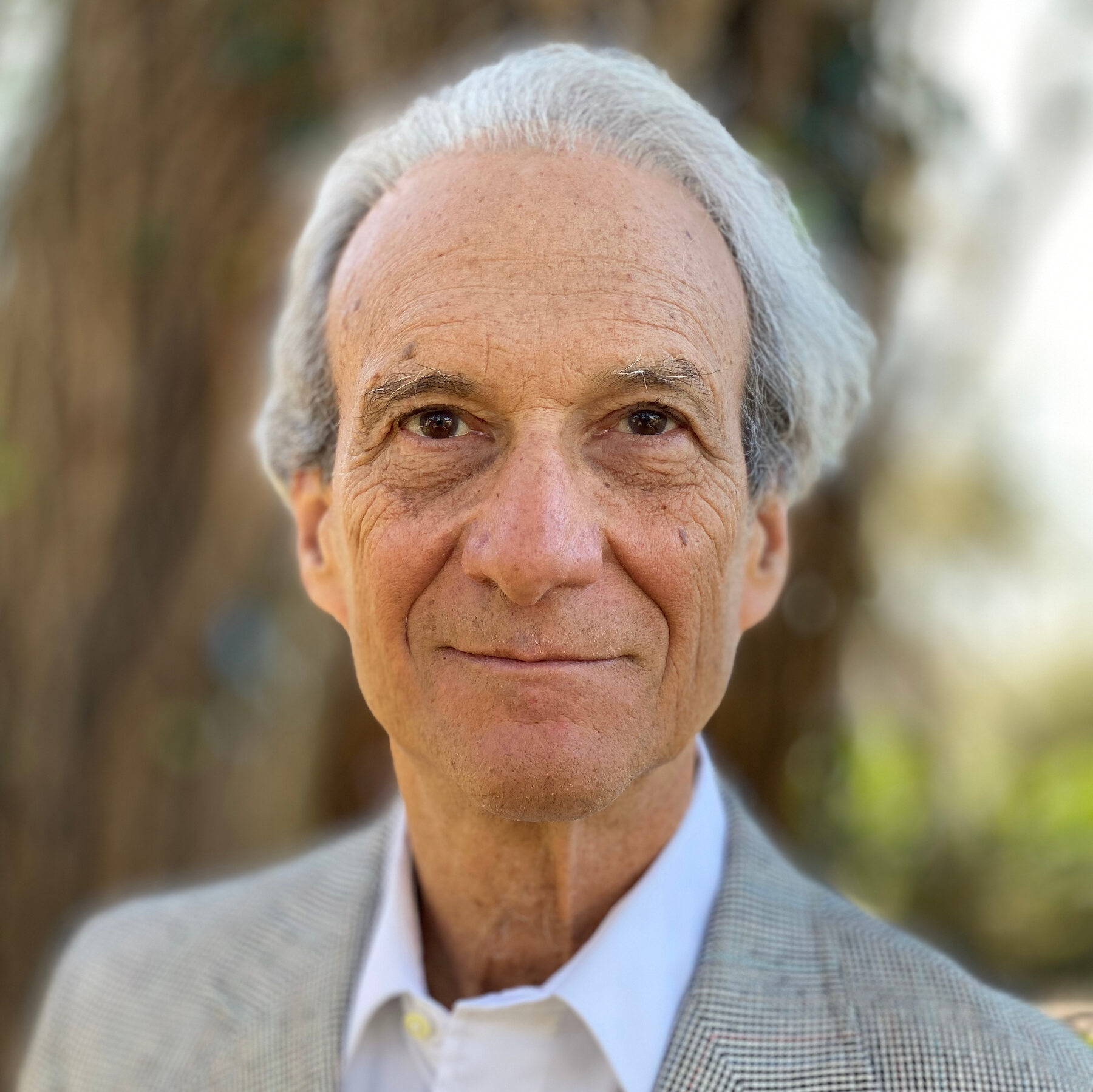

Jon Alper

Jon has been helping clients with asset protection for over 30 years. He has been recognized by fellow attorneys and national media as one of the leading experts in Florida asset protection law. Jon has been publishing legal articles about asset protection for over two decades.

Gideon Alper

Gideon specializes in asset protection law for individuals and small businesses. Previously an attorney for the IRS Office of Chief Counsel, Gideon now has over a decade of experience in advising clients with asset protection and estate planning. Gideon also provides services in real estate transfers and family adoptions.

Legal Services

Our attorneys help people throughout the state of Florida. All services can be provided remotely through phone and Zoom. Most services are provided on a flat-fee basis.

Client Reviews

Prospective clients may not obtain the same or similar results.