Florida Homestead Without a Will

Some clients are unsure what happens to their Florida homestead if they do not have a will. In some situations, a decedent’s only substantial asset was their homestead. When someone dies without a will they are said to have died intestate.

A person’s homestead in Florida generally passes free and clear of any creditor claims. The home is exempt from creditors under Article X, Section 4 of the Florida Constitution. Probate is a process designed to pay a decedent’s creditors. Because homestead is exempt from creditor claims the homestead is not part of a formal probate process.

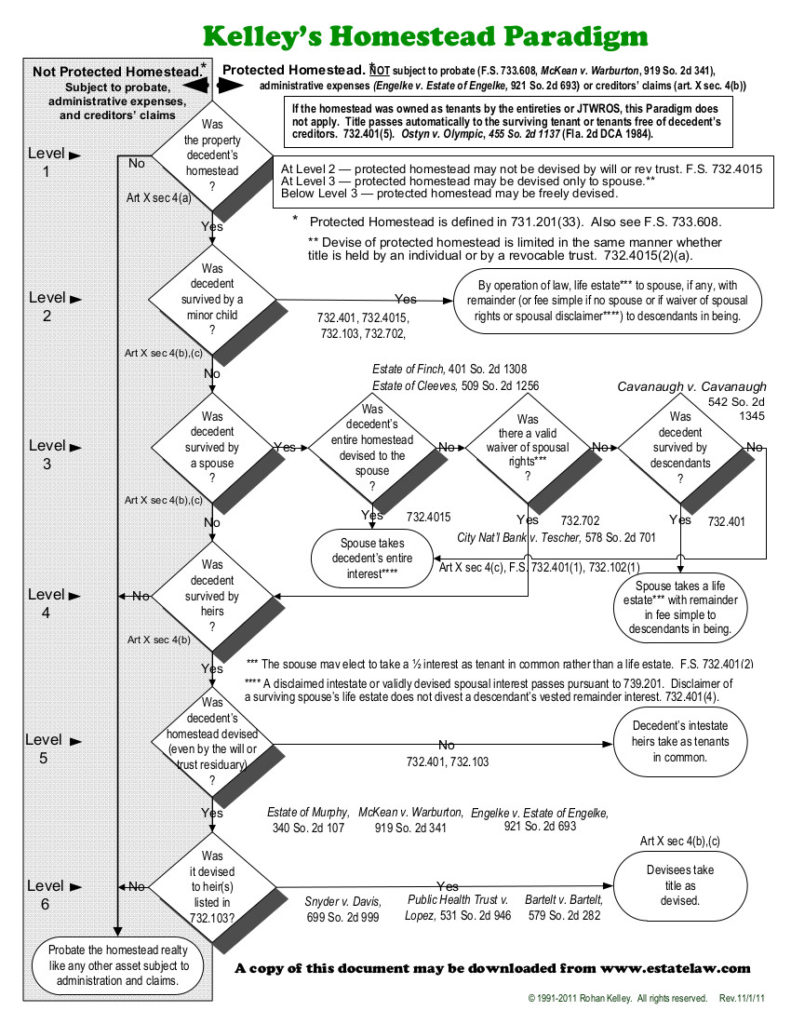

To determine what happens to a homestead when a decedent dies intestate attorneys use a well-known chart called Kelly’s Homestead Paradigm:

The Kelly’s Homestead Paradigm chart provides a series of yes or no questions that demonstrate what happens to a homestead with or without a will.

The general rule is that in most cases the homestead will pass to the surviving spouse and then the minor children, but as you can see from the chart there are many exceptions. For example, if a person dies with a spouse and no children, then the surviving spouse will inherit the homestead outright.

But what if there are children?

When there are surviving children the surviving spouse only inherits a life estate, which means that the surviving spouse has the right to stay in the home until their death. The children, on the other hand, will inherit a vested interest in the remainder. In other words, the children inherit the homestead upon the death of the surviving spouse and the termination of the life estate.

Sign up for the latest information.

Get regular updates from our blog, where we discuss asset protection techniques and answer common questions.