Offshore Trusts

An offshore trust is a legal structure that transfers ownership of assets to a licensed trustee company governed by foreign law. Because the trustee operates under foreign jurisdiction, domestic courts lack authority over the trust or its assets. A judgment creditor cannot force the foreign trustee to distribute funds, turn over records, or recognize a domestic court order.

A creditor who wants to reach the assets must instead hire a lawyer in the offshore jurisdiction, post a bond, and relitigate the claim under local rules that heavily favor the trust settlor. The cost, burden of proof, and procedural barriers make this path impractical for most creditors. In the Cook Islands, where most offshore trusts are established, no creditor has ever succeeded.

An offshore trust is the strongest asset protection structure available for people who face or anticipate personal liability and hold significant non-exempt wealth.

Speak With a Cook Islands Trust Attorney

Jon Alper and Gideon Alper design and implement Cook Islands trusts for clients nationwide. Consultations are free and confidential.

Request a Consultation

How Offshore Trusts Work

An offshore trust is governed by the laws of the jurisdiction where it is established. The trustmaker signs a trust deed naming a licensed foreign trust company as trustee and then transfers assets into the trust. Assets can be transferred directly to the trust or to a holding company owned by the trust, such as a Nevis LLC or a Cook Islands LLC. Once funded, the trustee holds legal title to the assets and manages them in accordance with the trust deed.

In most structures, the trustmaker is also the primary beneficiary. The trust deed gives the trustee discretion over distributions—meaning the trustee decides whether and when to release funds.

This trustee discretion is essential to the protection. If the trustmaker could withdraw funds at will, a court could simply order the trustmaker to hand those funds to a creditor. Because the trustee controls distributions, that order has no teeth.

The trustmaker can request distributions, and in ordinary circumstances, the trustee honors those requests. But the trustee has no legal obligation to comply. When a lawsuit arises, the trustee’s ability to say “no” is the mechanism that keeps assets safe.

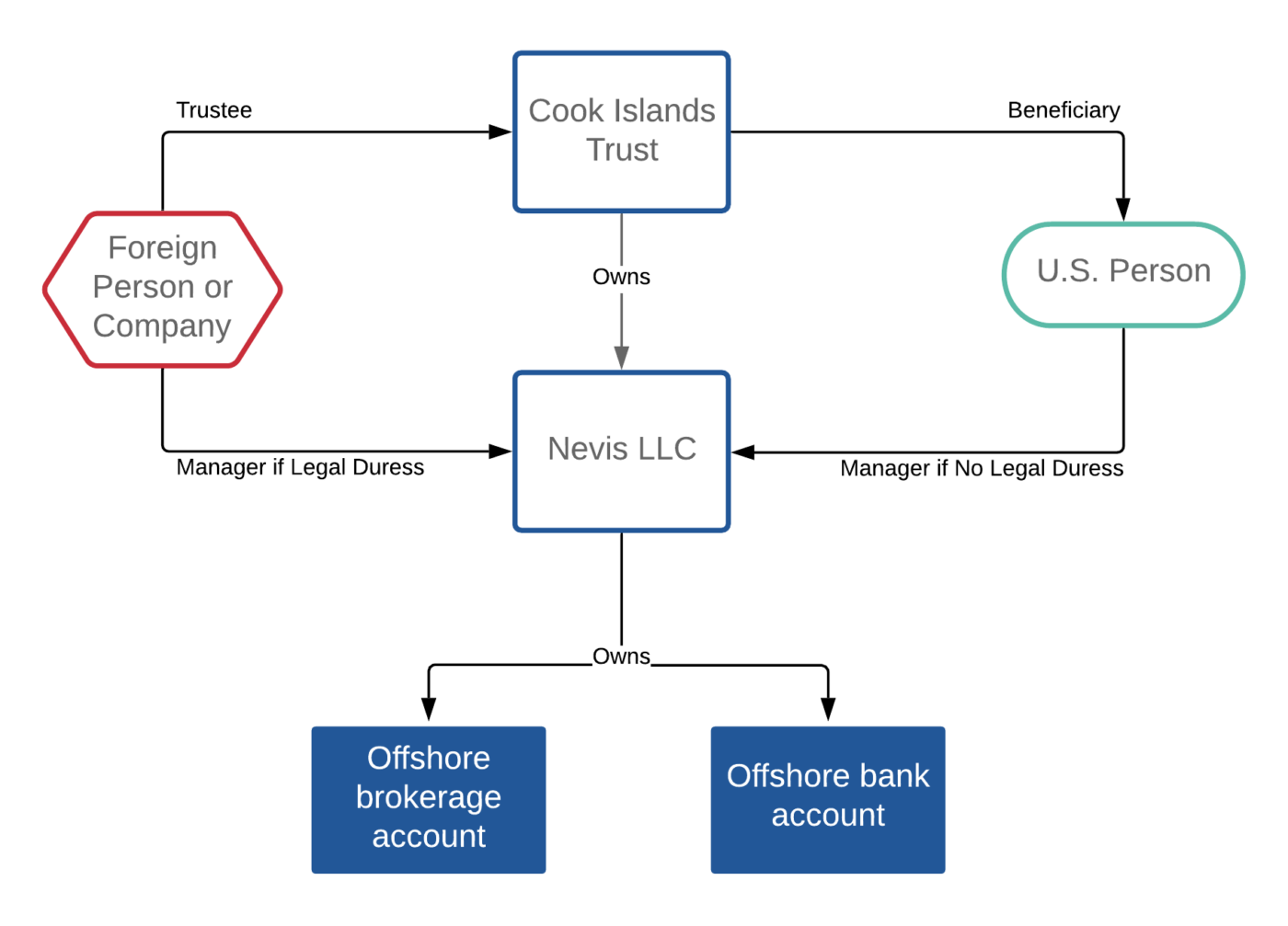

Typical Structure

Most offshore trust plans use a layered structure. A common arrangement pairs a Cook Islands trust with a Nevis LLC or Cook Islands LLC. The trust owns 100% of the LLC. The trustmaker serves as manager of the LLC during ordinary times, keeping day-to-day control over investments and bank accounts.

When a creditor threat arises, the trustee removes the trustmaker as the LLC manager and takes direct control, placing the assets beyond the reach of any U.S. court order. Once the threat passes, the trustmaker is restored as manager. How offshore trusts work in practice depends on how the trust deed, LLC operating agreement, and trustee protocols interact during this transition.

Advantages

There are four main advantages of offshore trusts: (1) creditor protection, (2) financial privacy, (3) estate planning, and (4) jurisdictional diversification.

Creditor Protection

An offshore trust’s primary advantage is that creditors cannot reach the assets. No creditor has ever breached a properly structured and timely funded offshore trust through Cook Islands litigation. This is not theoretical—it is the result of decades of actual cases.

The Cook Islands gives creditors a two-year window to bring a fraudulent transfer claim, requires proof beyond a reasonable doubt, and refuses to recognize foreign judgments. Once assets are properly in place, recovery by a creditor is practically impossible.

Financial Privacy

Offshore trusts offer financial privacy that domestic planning cannot match. Offshore trusts are not listed in public databases, are created in a foreign country, and the trust deed is a private document.

Estate Planning

An offshore trust also serves as an estate planning tool. The trustmaker can direct how assets pass to beneficiaries at death without probate, and the offshore protection continues for the next generation.

Jurisdictional Diversification

A person whose entire net worth falls within the U.S. legal system is fully exposed to its courts and political climate. An offshore trust moves a portion of those assets to a country whose laws favor the asset owner.

Disadvantages

There are two primary disadvantages of offshore trusts: (1) vulnerability in bankruptcy and (2) loss of control. Additional risks include fraudulent transfer exposure, limited effectiveness for U.S. real estate, and IRS reporting penalties.

Bankruptcy

Offshore trusts are least effective in bankruptcy. Federal bankruptcy trustees have worldwide jurisdiction over a debtor’s assets. Federal law requires the debtor, not the creditor, to bring their assets to the bankruptcy trustee. And the Bankruptcy Code allows clawback of transfers to self-settled trusts made within ten years of filing.

No one with an offshore trust would voluntarily file for bankruptcy, but involuntary petitions are a real risk.

Loss of Control

People have less control over their assets once transferred to an offshore trust. This is by design. When a court orders a trustmaker to bring assets back to the U.S., the defense is that the trustmaker genuinely cannot comply—the trustee controls the assets and is not subject to the court’s authority.

That defense only works if the trustmaker truly lacks the power to access the assets. The protection and the loss of control are inseparable. The contempt and repatriation risk is the most frequently litigated aspect of offshore trust enforcement.

Additional Risks

Additional risks to offshore trusts include exposure to fraudulent transfers from poorly timed transfers, limited effectiveness for U.S. real estate held through the trust, and IRS reporting penalties that can exceed the cost of the trust itself.

The disadvantages of offshore trusts are real constraints that narrow the pool of people for whom the structure makes economic sense.

Costs

Setting up an offshore trust costs $15,000 to $25,000 in legal fees. This covers drafting the trust deed, coordinating with the foreign trustee, forming any related entities, and handling the initial regulatory vetting.

Annual maintenance runs $3,500 to $7,000 for trustee administration, plus $3,000 to $5,000 for U.S. tax compliance. Total first-year costs typically range from $20,000 to $35,000, with annual ongoing costs of $7,000 to $12,000.

These costs make offshore trusts impractical for individuals with modest assets or low litigation risk. The minimum net worth at which the economics make sense depends on litigation exposure, not just total assets.

Legality

Offshore trusts are legal. No U.S. law prohibits a citizen or resident from setting up a trust in a foreign country, transferring assets to a foreign trustee, or holding assets in foreign bank accounts.

What the law does require is full disclosure. The IRS imposes significant reporting obligations on U.S. persons who create or fund foreign trusts, and the penalties for non-compliance are among the harshest in the tax code.

Tax Treatment

An offshore trust created by a U.S. person is treated as a grantor trust for tax purposes, which means the IRS looks through the trust entirely. The trust itself pays no taxes. All income, gains, losses, and deductions flow through to the trustmaker’s personal return, exactly as if the assets were still held directly. The offshore trust does not reduce, defer, or eliminate any U.S. tax obligation.

The reporting requirements include Forms 3520 and 3520-A annually. FBAR filings are required for foreign financial accounts with an aggregate value exceeding $10,000.

Form 8938 applies under FATCA. Failure to file can trigger penalties starting at $10,000 per form annually. Continued non-filing results in penalties equal to 5% of the trust’s assets.

The IRS reporting requirements for offshore trusts should be considered in initial trust planning. Offshore trusts are legal when properly set up, fully disclosed, and maintained in compliance with U.S. tax rules.

Best Jurisdictions

The Cook Islands and Nevis are the two best offshore trust jurisdictions. Both have laws specifically written to block creditor enforcement. Both require creditors to re-litigate in the offshore jurisdiction rather than register a U.S. judgment, and both impose short deadlines on fraudulent transfer claims and place the burden of proof on the creditor.

The Cook Islands have a stronger track record than Nevis. Its trust law has been tested in U.S. litigation more than any other offshore jurisdiction, and no creditor has recovered assets from a Cook Islands trust through Cook Islands proceedings. The best offshore trust countries differ meaningfully in their burden-of-proof standards, limitation periods, and litigation histories.

Nevis offers a viable alternative with lower costs and a creditor bond-posting requirement. The comparison between a Cook Islands trust and a Nevis trust turns on the tradeoff between the Cook Islands’ deeper litigation track record and Nevis’ cost advantages.

For individuals who need an offshore entity but not necessarily a trust, the distinction between offshore trusts and offshore LLCs matters because the two structures serve different functions and carry different costs.

Use Cases

Offshore trusts are appropriate for individuals whose litigation exposure and asset level justify the cost and complexity. The people who benefit most tend to hold significant liquid wealth, face above-average creditor risk from their profession or business activities, and have exhausted the domestic planning alternatives available in their state.

In divorce, an offshore trust can limit a spouse’s ability to enforce property division and support orders against trust assets, though family courts have broader powers than most creditors.

In bankruptcy, the analysis is more complex because federal courts have a broader reach and can claw back transfers made within ten years.

For cryptocurrency, an offshore trust addresses both protection and custody, since digital assets can be moved to the trustee’s control more easily than most other asset types.

Real estate presents the opposite challenge. U.S. property stays within U.S. court jurisdiction regardless of who holds title, though certain mortgage-based strategies can improve the position.

Offshore trusts are also used to protect IRAs and retirement accounts, and they are a standard tool for business owners whose companies create personal liability exposure.

Offshore Trust vs. Domestic Trust

Some U.S. states (including Nevada, South Dakota, Alaska, and Delaware) allow self-settled asset protection trusts that, on paper, compete with offshore trusts. These are significantly cheaper, carry no foreign reporting obligations, and use trustees located in the United States. The question is whether they hold up when tested.

The answer depends on the situation. In a dispute that remains within a single DAPT-friendly state where the creditor is a private party, a domestic trust may be sufficient. For any other situation, an offshore trust offers superior protection.

Courts in other states may not honor the protecting state’s law. In bankruptcy, the ten-year lookback applies equally to domestic and offshore transfers, and the domestic trustee must comply with U.S. court orders.

An offshore trust avoids these problems because the trustee operates in a country that simply refuses to recognize U.S. court orders. The offshore trust vs. domestic trust distinction is structural: a U.S. judge can compel a domestic trustee, but cannot compel an offshore one.

Bridge Trust Alternative

A bridge trust is a domestic trust that can migrate to an offshore trust jurisdiction upon certain events, typically the filing of a lawsuit or the entry of a judgment. For individuals who want offshore protection but are not ready to commit to a full offshore structure, the bridge trust reduces upfront costs and avoids foreign trust reporting requirements while no offshore structure is in place.

The trade-off is that the protection is not yet activated. If a creditor moves faster than the migration can be executed, the assets may still be within reach.

Hungarian Trusts

The Hungarian trust is a newer offshore trust option. Hungary enacted trust legislation in 2014, and the structure has attracted interest from European individuals and some U.S. planners seeking an EU-based alternative.

The Hungarian trust offers advantages in EU regulatory recognition and access to tax treaties, but it lacks the decades-long litigation track record that the Cook Islands and Nevis have built. Anyone considering a Hungarian trust should evaluate it against the established jurisdictions, specifically on creditor enforcement, not general structural flexibility.

Financial Accounts

An offshore trust needs foreign financial accounts to hold the trust’s assets. Most individuals use bank or brokerage accounts at European or Asian institutions without U.S. branches, placing the accounts beyond the subpoena power of U.S. courts.

The trustee, not the trustmaker, is the account holder and signatory. The trustmaker can request distributions, and in ordinary times the trustee processes them routinely. But the trustmaker has no independent access to the accounts, which is what makes them unreachable by creditors.

Opening foreign bank accounts for U.S. individuals without a trust has become increasingly difficult. Most reputable foreign banks no longer accept individual U.S. applicants because of FATCA compliance costs.

The offshore trust or LLC structure provides the workaround: the foreign entity opens the account, and the trustee maintains the banking relationship. Offshore bank accounts held within the trust structure require careful selection based on the institution’s willingness to work with Cook Islands or Nevis entities and its U.S. reporting infrastructure.

The offshore asset protection strategy for most U.S. residents combines a trust, one or more LLCs, and foreign financial accounts into a layered structure whose strength depends on the selection of jurisdictions, entity design, and ongoing compliance.