Inheriting Homestead Property in Florida

Inheritance of a Florida homestead is fast and easy. A Florida homestead is not subject to probate. Probate proceedings involve only assets subject to creditor claims. The Florida homestead is exempt from creditors, so it is not part of the probate estate. Therefore, title to a Florida homestead transfers to heirs quickly without waiting for the completion of probate proceedings.

A Florida homestead property is exempt from judgment creditors during the owner’s lifetime by the homestead provision of the Florida Constitution. The homestead exemption from creditors applies even after a judgment debtor’s death. A judgment lien does not attach to one’s homestead residence either during the owner’s lifetime or upon their death.

What happens to a Florida homestead after the owner dies?

Homestead protection continues after the owner dies. The surviving spouse or minor children will inherit a homestead no matter what is said in the will or the amount of money owed by the deceased owner.

A person’s homestead is not included in probate, and it cannot be liquidated to pay a decedent’s creditors. If the decedent’s heirs or trustees sell the homestead after death, the sale proceeds will pass to the decedent’s probate heirs and trust beneficiaries.

A creditor of the decedent has no additional remedies against the debtor’s homestead after the debtor’s death.

Homestead Protection After Moving to Long-Term Care

One of my clients last week expressed concern that their parent’s creditors would take the family house because their elderly parent was hospitalized for over a month with a terminal illness leading to their death.

Many debtors fear that their judgment creditor’s lien will automatically attach to the homestead property when they die if at the time of their death they no longer reside in the property.

For example, suppose the owner of a homestead moves to a long-term care facility or nursing home during their final months or years. Does a judgment lien attach to the property because the owner has moved out of the house to a long-term care residence or nursing home?

The Florida homestead exemption protects the decedent owner’s primary residence while they are alive as long as they have not abandoned the property. People can temporarily leave their homestead and retain homestead status if they intend to return. Most courts will not consider relocation for illness as an abandonment of homestead. Courts assume people intend to get better and go home again. Therefore, moving to a care facility prior to death should not jeopardize homestead protection.

We help protect what you’ve earned.

Jon Alper and Gideon Alper are nationally recognized experts in asset protection planning and implementation. In over 30 years, we have advised thousands of clients about how to protect their assets from judgment creditors.

We provide all services remotely by phone or Zoom.

Is a Florida Homestead a Probate Asset?

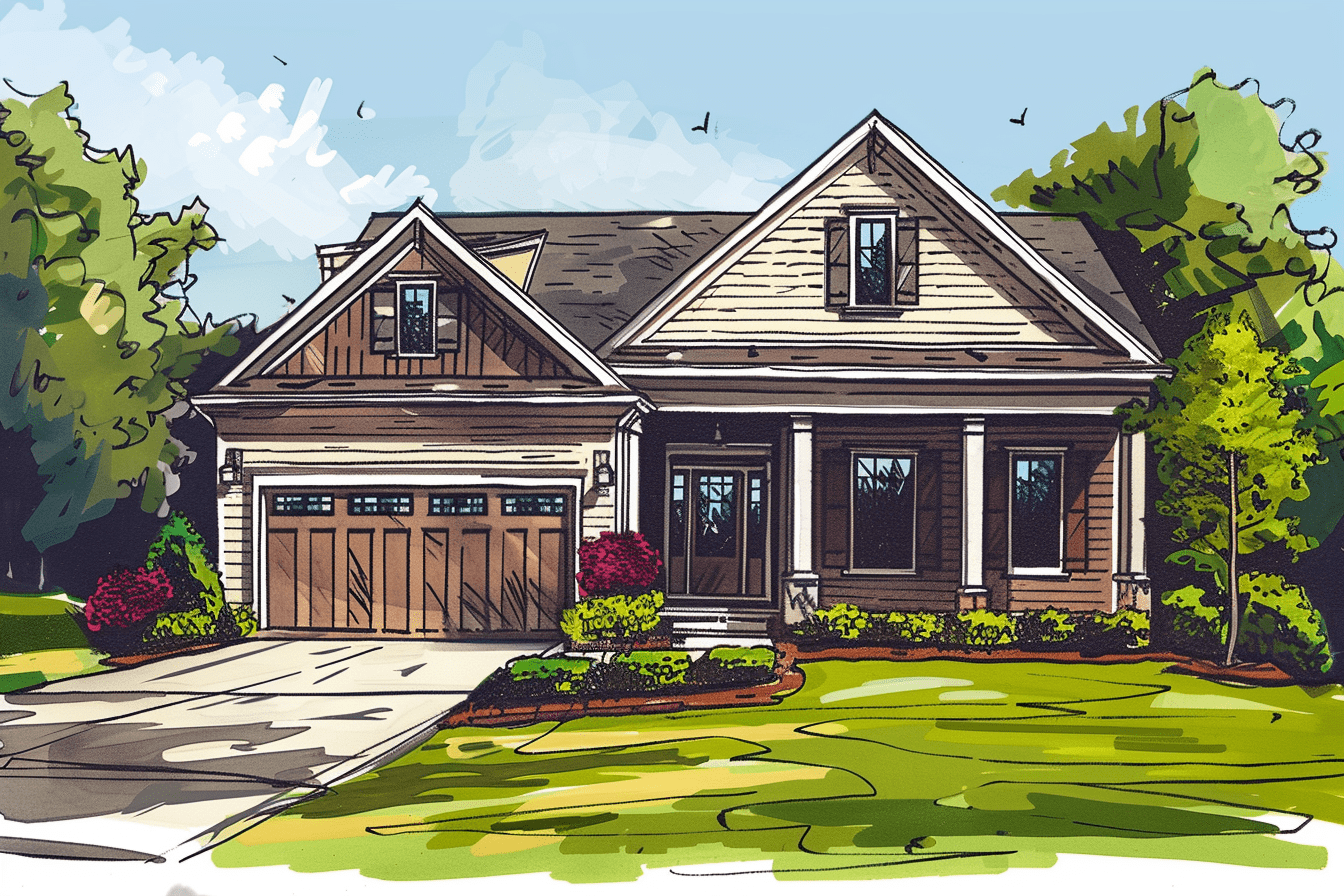

Often a person’s home is the most valuable asset they pass on to surviving family members. Sometimes the home is the only major asset to pass to a person’s beneficiaries. If a decedent owns assets in his name at death, the heirs need to open a probate proceeding to transfer legal title to the assets after first using the probate assets to pay claims filed by the decedent’s creditors, if any. Assets owned by the decedent and requiring probate comprise the “probate estate.”

The decedent’s homestead is not part of the probate estate because it is not subject to creditors. However, the personal representative of the decedent’s estate often still needs to obtain a court order stating that the property was the person’s homestead, particularly if the family plans to sell the former homestead. The heirs can request a court to issue an Order Determining Homestead Status.

If a decedent owns assets in his name at death, the heirs need to open a probate proceeding to transfer legal title to the assets after first using the probate assets to pay claims filed by the decedent’s creditors, if any. Assets owned by the decedent and requiring probate comprise the “probate estate.” The decedent’s homestead is not part of the probate estate because it is not subject to creditors.

Most people use a living trust to express their estate plan. An unmarried individual typically owns his homestead residence in a living trust. A living trust avoids probate of all assets titled in the name of the trust. Families expect to avoid the cost and delay of probate when the parents have transferred all assets, including their homestead residence, to a living trust. However, creditors may open a probate to assert claims against living trust assets other than the exempt homestead titled in the trust.

Selling the Homestead

Surviving family members assume that they can freely sell the parents’ homestead once they understand that it is not subject to claims against their parents’ estate, particularly if the homestead was titled in a living trust. Unfortunately, the family’s sale of a parents’ homestead can be more complicated. Title companies will not insure the sale of a decedent’s homestead unless the title examiner is sure that the property legally qualified as an exempt homestead, free of potential creditor claims.

A title company knows from the public records that a deceased parent owned their home. But it is not clear from the public records that the house was the parents’ homestead because public records do not indicate whether an owner resided in a property at or before death. Even though the owner may have previously applied for a homestead tax exemption, there is nothing recorded in real estate records identifying the occupant of the property. The deceased parent may have abandoned residency before death; for example, the parent may have been living with a child and may have rented the former homestead property to a tenant to get rental income to live on.

Title companies sometimes insist on a court order that the property was the owner’s homestead through death when the deceased owner had creditors. A court order requires a court proceeding, and the appropriate court proceeding is a formal probate. As a result, surviving family member wanting to sell the parents’ former residence may have to open probate even if the parents conveyed the house to a living trust and there are no probate assets.

The sole purpose of the probate is filing a court petition to declare the decedent’s residence to be their exempt homestead. The probate court routinely grants an order determining homestead status. This order ensures that the house is exempt from unknown claims and leads a title insurance company to issue insurance to potential buyers and their mortgage company.

Sign up for the latest information.

Get regular updates from our blog, where we discuss asset protection techniques and answer common questions.