Cook Islands Trusts

A Cook Islands trust is an offshore asset protection trust governed by the Cook Islands International Trusts Act 1984. It transfers legal ownership of assets to a licensed trustee in the Cook Islands, placing those assets beyond the direct enforcement reach of U.S. courts while allowing the person who created the trust to remain a beneficiary. The Cook Islands was the first jurisdiction in the world to enact legislation specifically designed for asset protection trusts, and its statutory framework has been tested in litigation for more than three decades.

No creditor has successfully broken a Cook Islands trust through Cook Islands court proceedings. U.S. courts have tried to compel repatriation and held settlors in contempt, but the assets themselves have remained protected when the trust was properly established and funded.

The structure exists for a specific purpose: to make it substantially more difficult for a creditor holding a U.S. judgment to collect against the trust’s assets. It does this by requiring creditors to abandon their U.S. judgment and start over in the Cook Islands, where they face a higher burden of proof, shorter filing deadlines, and a legal system that does not recognize foreign court orders against trust property.

The trust does not make assets untouchable. It changes the legal terrain a creditor must cross to reach them, and that change is often sufficient to alter settlement dynamics or end enforcement efforts entirely.

Cook Islands trusts are not general-purpose estate planning tools. They are expensive to establish, require ongoing compliance with U.S. tax reporting rules, and involve ceding a degree of direct control over assets to a foreign trustee. They are appropriate when litigation exposure is substantial, non-exempt assets are significant, and domestic planning alternatives have been evaluated and found insufficient.

Whether the structure fits a particular situation depends on a realistic assessment of exposure, asset profile, and tolerance for complexity. Our article on who needs a Cook Islands trust walks through that evaluation. Many of the claims that circulate about these trusts, particularly regarding tax benefits, total immunity, and secrecy, are wrong.

How a Cook Islands Trust Works

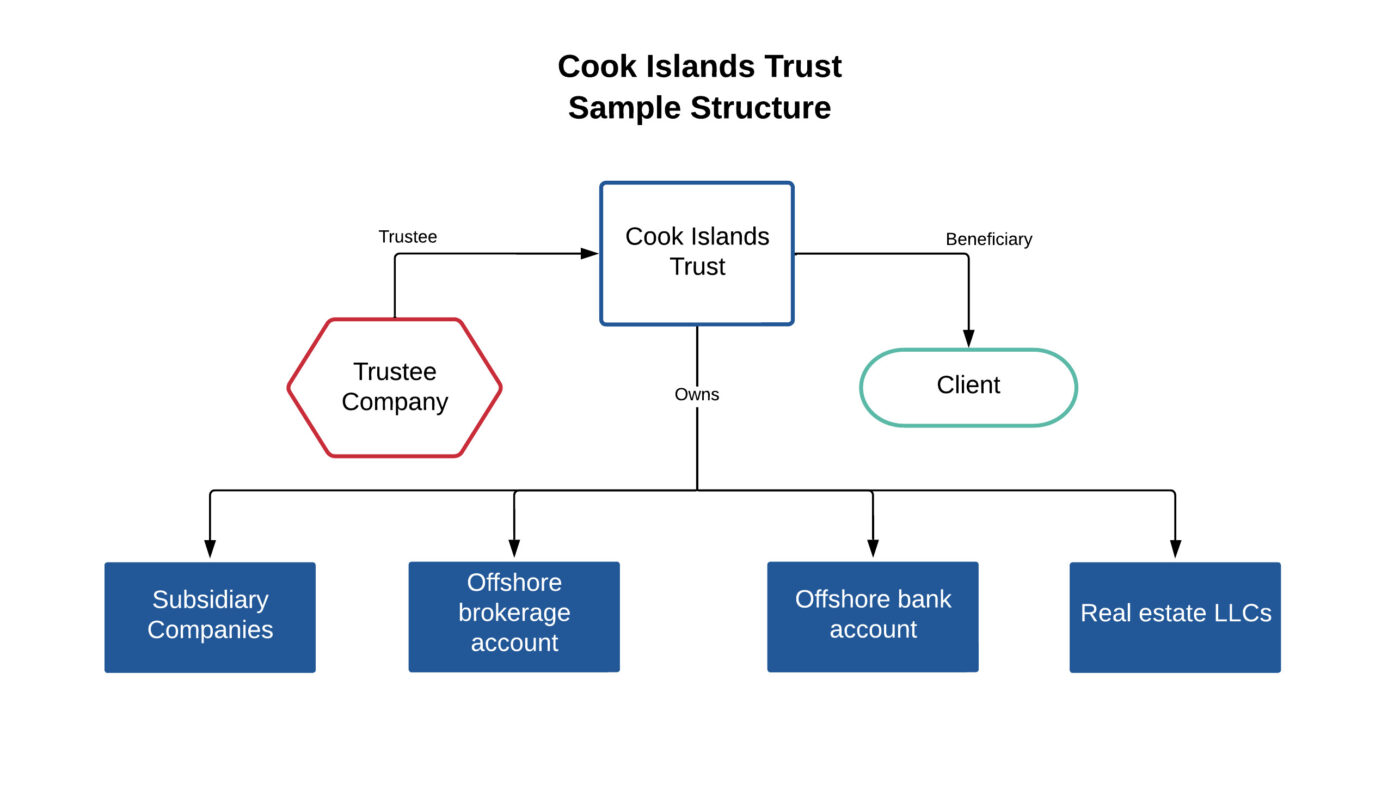

The settlor (the person creating the trust) transfers assets to a licensed Cook Islands trustee company, which holds legal title to those assets and administers them according to the trust deed. The settlor typically remains a discretionary beneficiary, meaning the trustee may make distributions to the settlor but is not required to do so.

In most structures, the trust does not hold assets directly. The trust owns an offshore LLC, and the LLC holds bank or brokerage accounts where the actual assets are kept. The settlor is typically appointed as the initial manager of the LLC, retaining practical day-to-day control over investments during normal circumstances.

If litigation arises, the trust deed and LLC operating agreement contain provisions that shift management authority from the settlor to the trustee. This removes the settlor’s ability to direct the assets and creates a separation that is both legally meaningful and practically consequential. The settlor can truthfully represent to a U.S. court that they do not have the legal authority to comply with a repatriation order—the trustee does, and the trustee is governed by Cook Islands law, not U.S. court orders.

The trust deed is the governing document that defines these roles, the protective provisions that activate under pressure, and the terms under which the trustee operates. A well-drafted trust deed includes a duress clause that automatically restricts trustee actions when the settlor is under legal compulsion, a flight clause that allows the trust to be re-domiciled to another jurisdiction, spendthrift provisions that prevent beneficiaries from assigning their interests to creditors, and choice-of-law clauses that direct disputes to Cook Islands courts. The quality of this document determines whether the structure actually works when tested.

Speak With a Cook Islands Trust Attorney

Attorneys Jon Alper and Gideon Alper specialize in Cook Islands trust planning and offshore asset protection. Consultations are free and confidential.

Request a ConsultationLegal Framework

The Cook Islands International Trusts Act 1984, as amended most significantly in 1989, provides the statutory foundation. Three provisions are central to why the structure works.

A U.S. judgment has no legal effect in the Cook Islands. Section 13D of the ITA provides that no foreign judgment is enforceable if it is based on any law inconsistent with the Act. A creditor who wins in a U.S. court must file a new proceeding in the Cook Islands High Court and litigate the claim from scratch under Cook Islands law.

The burden of proof on creditors is the highest available in civil proceedings. Under Section 13B, a creditor must prove beyond a reasonable doubt that the settlor transferred assets with the intent to defraud that specific creditor and that the transfer rendered the settlor insolvent. This is dramatically more difficult to meet than the preponderance-of-evidence standard applied in U.S. fraudulent transfer cases.

Filing deadlines are short. Section 13K requires a claim to be filed within one year of the trust being funded or within two years of the creditor’s cause of action accruing, whichever is shorter. After these periods expire, the Cook Islands courts will not hear the claim. Each transfer to the trust starts its own clock.

Structure

The settlor, trustee, protector, and beneficiaries each have defined roles in a Cook Islands trust.

The settlor creates the trust and transfers assets to it. Under Section 13C of the ITA, the settlor may retain significant powers—including the power to revoke the trust, direct investments, add or remove beneficiaries, and remove or appoint the trustee—without invalidating the trust or its asset protection features. This is a critical distinction from U.S. law, where retained powers can compromise a trust’s protective value.

The trustee is a licensed Cook Islands trust company that holds legal title to trust assets and administers the trust according to the trust deed and Cook Islands law. The trustee interacts with creditors and courts, and its independence from the settlor is essential to the structure’s integrity.

The protector is an optional but common role, typically filled by someone the settlor trusts, who has the power to remove and replace the trustee. The protector adds a layer of oversight without controlling trust assets directly. This role becomes important if the trustee acts contrary to the settlor’s interests or if the trustee company needs to be changed during the life of the trust.

The beneficiaries are the individuals or entities entitled to benefit from the trust. In most asset protection structures, the settlor is a discretionary beneficiary, which means the trustee has the authority but not the obligation to make distributions. This discretionary structure is intentional: it means no beneficiary has a fixed entitlement that a creditor can attach. Our administration guide explains how these roles interact in practice, including the mechanics of distributions, withdrawals, and the common mistakes that undermine trust protection.

What a Cook Islands Trust Protects Against

Civil judgments from lawsuits are the primary use case. A creditor who wins a judgment in a U.S. court cannot enforce that judgment directly against trust assets. The creditor must pursue the assets in the Cook Islands, where the statutory protections described above apply. Our litigation guide covers the full enforcement landscape, including what happens after a U.S. judgment is entered and the contempt risks a settlor may face.

Professional liability claims from physicians, real estate developers, business owners, and executives in litigious industries may exceed insurance coverage. A Cook Islands trust provides a second layer of protection behind insurance and state exemptions.

Divorce is addressed by the Cook Islands’ International Relationship Property Trust Act, enacted specifically to protect trust assets from division in divorce proceedings. A trust established with proper spousal involvement and independent legal advice can preserve assets for the family unit. The issues that arise when setting up while married include community property, spousal consent, and the IRPT framework.

Post-sale liability affects business owners who sell a company and give vendor warranties. A Cook Islands trust established before the sale can protect the proceeds during the warranty period.

What a Cook Islands Trust Does Not Do

It does not reduce taxes. A Cook Islands trust is tax-neutral for U.S. persons. The IRS treats it as a foreign grantor trust, and all income, gains, and deductions flow through to the settlor’s personal return. The settlor pays the same taxes as if the assets were held directly. Anyone suggesting otherwise is either mistaken or selling something illegal.

It does not eliminate reporting obligations. U.S. persons with a Cook Islands trust must file Form 3520 and Form 3520-A annually, report foreign financial accounts on the FBAR (FinCEN Form 114), and disclose specified foreign financial assets on Form 8938. Penalties for non-compliance are severe. Our compliance guide covers each filing requirement in detail.

It does not make assets disappear. The trust must be disclosed on tax returns, in discovery proceedings, and in response to lawful court inquiries. Attempting to conceal a Cook Islands trust is illegal and counterproductive.

It does not guarantee immunity from contempt. A U.S. court can hold the settlor in contempt for failing to comply with a repatriation order, even if the trustee independently refuses to release the assets.

Costs

A Cook Islands trust costs more to establish and maintain than any domestic planning alternative. For most clients, first-year costs include $15,000 to $20,000 in U.S. legal fees, $3,500 to $5,000 in trustee formation fees, and $500 to $2,000 for entity formation.

Ongoing annual costs include $3,300 to $5,000 in trustee administration fees, $1,500 to $3,000 in U.S. tax preparation for the required foreign trust returns, and custodial fees charged by the offshore bank or brokerage. Our costs guide provides a comprehensive breakdown of setup, ongoing, and situational expenses.

How to Set Up a Cook Islands Trust

The formation process involves six sequential stages: initial consultation and planning with U.S. counsel, trustee application and due diligence, trust deed drafting and execution, trust registration with the Cook Islands High Court, entity formation (if the structure includes an LLC), and account opening and funding. The process typically takes four to eight weeks for straightforward cases and eight to twelve weeks for more complex structures.

The most common source of delay is the trustee’s KYC and AML compliance review, which requires identity verification, proof of address, source of funds documentation, and tax residency certification for every controlling person associated with the trust. Our setup guide walks through each stage of the process.

Establishing a Cook Islands trust during active litigation is possible but involves materially higher risk. The fraudulent transfer analysis changes, the timing of the trust’s creation becomes a central issue, and the settlor’s exposure to contempt increases.

Funding

A Cook Islands trust can hold a wide range of assets, but the mechanics of transferring different asset types into the structure vary significantly.

Cash and securities are the most straightforward to transfer. The trust or its LLC opens an offshore bank or brokerage account, and assets are moved by wire transfer or account transfer. The settlor can typically continue to manage the investment portfolio through the LLC during normal circumstances.

Real estate cannot be moved offshore in the same way. If the trust holds U.S. real property, the land remains within the jurisdiction of U.S. courts, which limits the protection. Practitioners address this by transferring LLC membership interests rather than the real property itself, but the analysis depends on the type of property and how it is titled.

LLC and business interests can be transferred by assigning membership interests to the trust. This is common for settlors who own operating businesses or investment entities and want to place the equity beyond creditor reach while maintaining management control through the LLC structure.

Cryptocurrency presents unique custody, valuation, and compliance challenges. The trust can hold digital assets, but the custodial arrangements and reporting obligations differ from traditional financial accounts.

Our funding guide covers the mechanics for each asset type, including a practical checklist and the errors that most frequently compromise protective value.

Cook Islands Trusts vs. Other Jurisdictions

The Cook Islands has the longest track record and the most developed body of case law of any offshore trust jurisdiction. Other jurisdictions commonly compared to the Cook Islands include Nevis, Belize, the Bahamas, Cayman Islands, and Panama, as well as domestic asset protection trust states like Nevada, Delaware, and South Dakota.

The Cook Islands’ advantage is not any single statutory provision. Several jurisdictions have modeled their laws on the Cook Islands framework. The advantage is the combination of a tested legal framework, a robust trustee market with multiple licensed trust companies, a judiciary that has consistently upheld the ITA’s protective provisions, and more than three decades of real-world litigation outcomes that demonstrate how the system actually functions under pressure.

The comparison with domestic asset protection trusts is more fundamental. DAPTs operate within the U.S. legal system and remain subject to the Full Faith and Credit Clause, federal bankruptcy jurisdiction, and the enforcement powers of U.S. courts. A Cook Islands trust operates outside that system entirely. Our comparisons guide provides detailed side-by-side analyses with each competing jurisdiction.

Administration and Ongoing Management

A Cook Islands trust requires active administration throughout its life. The trustee monitors trust activity, maintains compliance files, files annual FATCA and CRS reports, and exercises its fiduciary duties under Cook Islands law. The settlor must coordinate with U.S. tax advisors to meet annual filing obligations and with the trustee to execute any transactions involving trust assets. Our administration guide covers common administrative issues and the mistakes that undermine trust protection.

Frequently Asked Questions

Is a Cook Islands trust legal? Yes. Cook Islands trusts are legal for U.S. citizens when established for lawful purposes, administered by an independent trustee, and fully disclosed on required IRS filings.

Can a Cook Islands trust be broken? No creditor has successfully broken a Cook Islands trust through Cook Islands court proceedings. A creditor must litigate in the Cook Islands, meet the beyond-reasonable-doubt standard, and file within the statute of limitations. U.S. courts can hold settlors in contempt for failing to comply with repatriation orders, but the trust assets themselves have remained protected when the structure was properly established. The litigation section and case library analyze the case law in detail.

How much does a Cook Islands trust cost? First-year costs typically range from $20,000 to $30,000, including legal fees, trustee fees, and entity formation. Annual maintenance costs are $5,000 to $10,000. Our costs guide provides a complete breakdown.

How long does it take to set up a Cook Islands trust? Four to eight weeks for straightforward cases, eight to twelve weeks for complex structures. Banking onboarding is typically the longest stage. Our setup guide covers the full timeline.

Can I still access my money? In normal circumstances, the settlor can request distributions from the trustee or manage assets through the LLC. When litigation arises, the trust’s protective provisions may limit access, which is by design—the inability to direct assets is what protects them from creditor enforcement.

Who should consider a Cook Islands trust? Individuals with substantial non-exempt assets, elevated litigation exposure, and circumstances where domestic planning tools are insufficient. Our article on who needs a Cook Islands trust provides a detailed evaluation framework.

Do Cook Islands trusts reduce taxes? No. For U.S. persons, Cook Islands trusts are tax-neutral. All income is reported on the settlor’s personal tax return.

Sign up for the latest information.

Get regular updates from our blog, where we discuss asset protection techniques and answer common questions.