Pros and Cons of Offshore Trusts

What Is an Offshore Trust?

An offshore trust is a legal tool that allows an individual to safely protect their assets from creditors. An offshore trust works by transferring ownership of the assets to a foreign trustee outside the jurisdiction of U.S. courts. While not required, typically the offshore trust only holds assets located outside of the United States.

Assets placed in an offshore trust are shielded from U.S. court orders, making it extremely difficult for creditors to reach them.

Offshore trusts are most effective for protecting cash, securities, and business interests rather than U.S.-based real estate.

How an Offshore Trust Works

An offshore trust protects a U.S. debtor’s assets from U.S. civil judgments primarily because the trust’s assets and its trustee are situated beyond the legal reach of U.S. state and federal civil courts. U.S. judges have no authority to compel an offshore trustee to take any action with trust assets. Creditors do not have legal means to levy upon or interfere with the administration of an offshore trust’s assets.

The best offshore trust jurisdiction is the Cook Islands. Cook Islands trusts can be designed to protect all trust assets from U.S. civil creditors.

To levy or garnish offshore trust assets when using a Cook Islands trust, a U.S. judgment creditor must re-litigate the underlying U.S. lawsuit in the Cook Islands and obtain a new foreign judgment. This is difficult, expensive, and rarely done.

What Are the Advantages of Offshore Trusts?

An offshore trust provides several advantages to a U.S. judgment debtor. First, Offshore trusts are one of the most powerful tools to protect assets from creditors and domestic judgments. U.S. private creditors very rarely have the resources or desire to chase a judgment debtor’s assets outside of U.S. jurisdiction. Very few collection attorneys even know how to begin to initiate collection proceedings against assets located offshore.

Secondly, outside of litigation, the general public will be unable to find out the beneficiary of the offshore trust. This keeps financial affairs more private.

Finally, offshore trusts can be used in conjunction with general estate planning to make sure that your assets go to designated beneficiaries upon your death. At the same time, the trust agreement can accommodate estate tax planning to minimize the risk of any tax liability.

In summary, here are the three most important benefits of an offshore trust:

- Provides the highest level of asset protection.

- Removes your assets from the oversight of state courts.

- Allows you to distribute your assets properly upon your death.

We help protect what you’ve earned.

Alper Law has helped clients with asset protection planning for for over 30 years. We develop creative, customized strategies to protect our clients from judgments and creditors.

Attorneys Jon Alper and Gideon Alper are nationally recognized as leading experts in offshore trust formation.

Offshore Trusts Can Protect Assets

Offshore trusts are a component of offshore asset protection planning. Offshore asset protection is an asset protection tool that involves forming a trust or business entity in a favorable legal jurisdiction outside of the United States. Offshore assets are placed under the control of trustees or managers who are not United States citizens and do not have a business presence in the United States.

People with significant assets and higher risks of legal liability can employ offshore asset protection to move legal battles with creditors to jurisdictions beyond the reach of United States courts.

Offshore trusts are most effective when protecting movable intangible assets such as bank deposits, marketable securities, small business stock, limited partnership interests, and LLC interests. These assets may be effectively moved beyond U.S. court jurisdiction by changing ownership to the foreign trustee of a foreign trust.

Offshore Trusts Can Sometimes Protect Real Estate

On the other hand, offshore trusts are not as effective in protecting real estate located in the U.S. In general, real estate is subject to the powers of the courts of the jurisdiction where the property is located. Even if a debtor re-titles U.S. real estate in the name of an offshore trust or an offshore LLC, a U.S. court will still have jurisdiction over the debtor’s equity and the property title because the property remains within the U.S. court’s geographical jurisdiction.

Offshore planning may protect U.S. property if the property is encumbered by a mortgage to an offshore bank. Offshore banks typically pay higher CD rates than U.S. banks. A prospective debtor can borrow funds from an offshore bank, hold the funds offshore in a CD, and secure the loan with a lien on the property. The CD interest would cover most of the loan expense. Alternatively, the loan proceeds may be held at a U.S. bank that is immune from garnishment, albeit earning lower interest rates but with more convenient access to the money.

Disadvantages of Offshore Trusts

- Limited Legal Protections for Beneficiaries. Offshore trusts are governed by the laws of the jurisdiction where they are established, which often differ significantly from U.S. law. If a dispute arises, beneficiaries may have difficulty enforcing their rights in a foreign court. This can make offshore trusts less predictable and riskier compared to domestic options.

- High Costs to Set Up and Maintain. The cost of creating an offshore trust is significantly higher than a domestic trust. You’ll need to pay for legal fees, trustee services, and annual compliance requirements, which can include tax filings and reporting obligations. These ongoing costs make offshore trusts impractical for individuals with smaller estates.

- Regulatory and Tax Scrutiny. Offshore trusts often attract attention from the IRS and other regulatory authorities. Failure to comply with international reporting requirements, such as FATCA or CRS, can lead to severe penalties. Managing these compliance requirements adds complexity and risk for trust owners.

2025 Update for Offshore Trusts

In 2025, offshore trusts are being shaped by tighter tax regulations, increased transparency demands, and new asset classes. Tax reforms, especially in the UK, are bringing more offshore trust assets into inheritance tax rules, requiring proactive planning.

Trustees are also adapting to manage digital assets like cryptocurrencies and are seeing a growing push toward sustainable, ethical investments. While traditional jurisdictions like the Cook Islands and Nevis remain strong, emerging locations like the United Arab Emirates are attracting attention for their favorable trust laws and tax benefits.

Requirements to Form an Offshore Trust

- The trust must be irrevocable.

- The U.S. debtor cannot be the trustee.

- The trust must provide the trustee the discretion to withhold payment from the beneficiary.

- The trustee must be a foreign trust company or financial institution.

- The trust protector cannot be located in the United States.

- The trust must state that the location of the trust (called the situs) governs trust provisions.

- The trust must own the assets either directly or through a foreign entity such as an LLC that the debtor can control when not under legal duress.

Ongoing Costs of Maintaining an Offshore Trust

Setting up an offshore trust involves a one-time cost, but maintaining the trust also carries annual expenses. Most offshore trustees charge administrative fees ranging from $3,000 to $6,000 per year, depending on the jurisdiction and the complexity of the trust. In addition, there may be banking fees for wire transfers, currency exchange charges, and costs for legal or accounting updates if the trust structure needs to be modified over time.

Offshore trusts are generally most cost-effective when protecting at least $250,000 or more in assets. Clients with smaller amounts of wealth may find that the ongoing maintenance costs outweigh the benefits of offshore asset protection.

Example Offshore Trust Plan

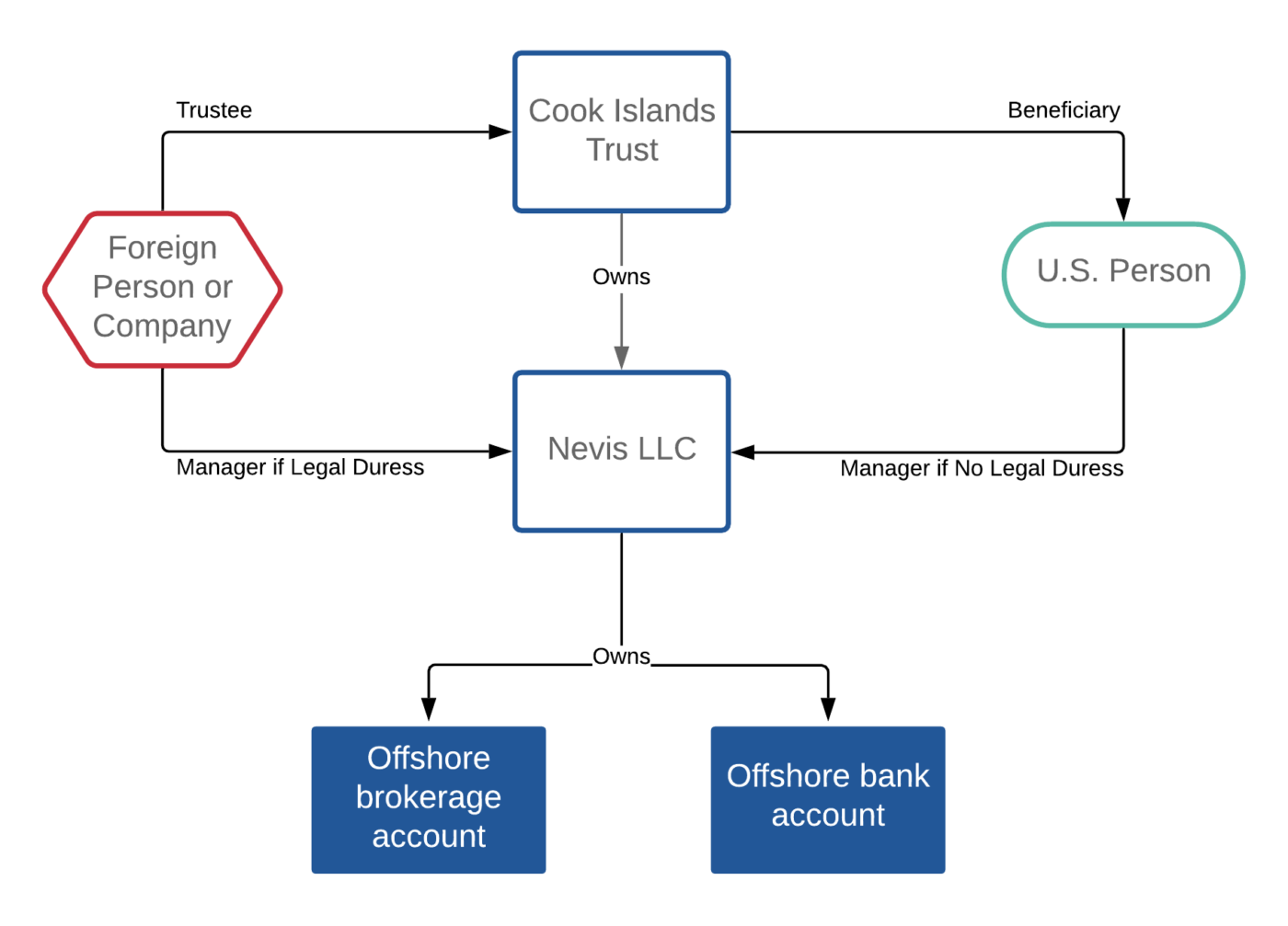

Many offshore trust plans involve more than one legal entity. For example, a U.S. resident can establish an offshore trust and a U.S. limited partnership or an offshore limited liability company.

Most offshore LLCs are formed in Nevis, which for some time has been a favored LLC jurisdiction. However, recent changes to Nevis tax and filing requirements have led to LLCs in the Cook Islands.

For example, a U.S. person could form a Nevis LLC and transfer their business interests and liquid assets to the LLC. The person could next establish a Cook Islands trust using an offshore trust company as a trustee. The LLC issues membership interests to the trustee of the Cook Islands trust. The Cook Islands trust would own 100% of the Nevis LLC. The U.S. resident could serve as the initial manager of the Nevis LLC with the option of appointing an offshore manager should the person ever become under legal duress.

With this type of offshore trust structure, the Nevis LLC is managed by the U.S. individual when there are no anticipated lawsuits. Once a legal issue arises, the trustee of the offshore trust should remove the U.S. individual as manager of the Nevis LLC and then appoint a successor manager that is also offshore.

The plan diversifies control over two separate jurisdictions instead of putting all the assets in either the LLC or the trust.

How to Set Up an Offshore Trust

1. Select a Jurisdiction

The first step to forming an offshore trust is selecting a trust jurisdiction. In our experience, the Cook Islands offers the best combination of trustee regulation, favorable debtor laws, and positive litigation outcomes compared to other jurisdictions. Nevis, W.I., Bahamas, Belize, and some countries in eastern Europe are also good options.

2. Pick a Trustee Company

A U.S. citizen must hire a person or company based in a foreign trust jurisdiction to serve as a trustee. Many people do not know which offshore trust trustees are reputable. U.S. citizens typically hire a domestic trust company, or a U.S. asset protection attorney to help them find an offshore trustee in a suitable jurisdiction.

3. Pass a Background Check

All offshore trustee companies perform a background check on all grantors and beneficiaries of the offshore trust. The trustee company will use software to verify your identity and investigate your current legal situation in the U.S. Trust companies do not want clients who may involve the company in investigations or litigation, such as disputes involving the U.S. government.

You must disclose pending litigation and investigations as part of the background check. The trustee company may require that the trust documents carve out an exception for any pending litigation, and the trustee will not defend the trust against claims by the plaintiff in that matter.

Most people pass the background check without issue.

4. Draft the Trust Document

Your domestic asset protection attorney will work with the offshore trustee company to draft the offshore trust agreement. If you include other entities in the structure, such as a Nevis LLC, the attorney will also draft the agreements for those entities.

The trust agreement can be customized based on your asset protection and estate planning goals.

5. Transfer Assets into the Trust

The final step in offshore trust formation transferring assets to the trustee of the offshore trust. If the trust owns an offshore LLC which will be owned by the offshore trust, then the trustmaker’s personal assets will be transferred to the LLC rather than the offshore trust.

The offshore trust structure works best when the trust assets are held offshore. The trustee company can assist in opening financial accounts for the trust or its wholly-owned LLC that are located in foreign jurisdictions.

Best Offshore Trust Jurisdictions

It is more important to select the best trustee than the best offshore trust jurisdiction. In fact, trustee selection is the most important part of offshore trust asset protection. The offshore trustee controls the trustmaker’s assets. The trustee must be competent, responsive, and trustworthy. The offshore trustee can be a bank, a trustee company, or an individual in another country.

The trust plan works best when the trustee is a professional or a well-established and secure business, and most importantly, is willing to defend the offshore trust against attacks initiated by U.S. creditor collection. A person considering an offshore trust should investigate, and if feasible, personally meet with, a prospective foreign trustee before appointing them as trustee of their offshore trust.

There are reputable and experienced companies serving as trustees of offshore trusts. These companies carry insurance policies issued by well-known insurance companies that insure their customers against loss from negligence and criminal acts of the trustee’s agents and employees. Some trust companies are also audited by national U.S. accounting firms, and they offer the audit results and their insurance certificates to prospective offshore trust clients.

Most people would like to retain control of their own assets held in their offshore trust by having the power to remove and replace the trustee. Retaining the power to change an offshore trustee creates legal risks. A U.S court may not have direct authority over assets held offshore, but the court does retain personal jurisdiction over the trustmaker who resides in the United States. A judge could order the debtor to exercise their retained rights to substitute a creditor agent for the current offshore trustee. Therefore, offshore trust asset protection works best if the trustmaker has no control over trust assets or other parties to the trust. The trustmaker should not retain any powers that they could be forced to exercise by a U.S. court order.

Some trustee companies permit the trustmaker to reserve primary discretion over trust investments and account management in the position of trust advisor. This arrangement gives the trustmaker some control over assets conveyed to the trust, and the trustmaker can give up rights if they are threatened with legal action, leaving the offshore trustee in sole control. Another option is for the trustmaker to name a trust protector who is not subject to U.S. court jurisdiction. The trust protector can remove a trustee who is not responsive or who is not taking good care of trust assets.

Offshore Jurisdiction Costs and Considerations

The jurisdiction where an offshore trust is established can significantly impact both initial setup and annual maintenance costs. Jurisdictions like the Cook Islands and Nevis are popular not only for their strong asset protection laws but also for offering trustee services at predictable and competitive rates.

More remote or less established jurisdictions may advertise lower fees, but they often come with weaker legal protections or hidden charges.

Our most popular article…

We provide a complete guide to Florida asset protection law.

Offshore Trust Bank Accounts

Many people believe they can protect cash deposits from creditors by opening an offshore trust bank account. People assume that a judgment creditor cannot garnish their accounts at a bank with no U.S. branches or offices.

However, it has become difficult for a U.S. citizen to open a foreign bank account in their own name. Most reputable foreign banks do not accept U.S. citizens as individual bank customers. Secret bank accounts do not exist because of treaties between the U.S. and most countries following 9/11.

The way to deposit money in a foreign bank is to first establish an offshore LLC or offshore trust. Then, the debtor requests the foreign LLC manager or offshore trustee to open the account in the name of the foreign entity.

Foreign managers and trustees have relationships with banks that enable them to open accounts on behalf of their U.S. clients. Offshore trustees usually maintain their client’s financial accounts at E.U. institutions that have no U.S. branches. E.U. financial institutions can purchase U.S. marketable securities and maintain bank accounts in U.S. dollars. The trustmaker does not have direct access to offshore trust financial accounts, but they can request distributions from the offshore trustee

Turnover and Contempt Orders with Offshore Trusts

The possibility of turnover orders and civil contempt charges is a significant risk in offshore asset protection. Debtors relying on offshore trusts should consider the possibility of a domestic court order to bring back assets transferred to a debtor’s offshore trust.

The impossibility of compliance is a defense to civil contempt. A court will not imprison someone for failure to do something that can’t be done. In instances when a court orders a debtor to unwind an offshore trust plan, the debtor can claim that compliance is impossible because the trust is under the control of an offshore trustee.

But it’s not as simple as invoking an impossibility defense and saying, “I can’t.” Some recent court decisions treat a transfer of assets to an offshore trust as an intentional act of creating an impossibility. The courts then disallow the impossibility defense to the contempt order because the impossibility is of the debtor’s own making.

Offshore Trust Taxation

An offshore trust does not eliminate or reduce a U.S. taxpayer’s obligation to report income and pay taxes. Offshore trusts are considered “tax-neutral” tools, meaning they can protect assets but do not create tax benefits or help avoid tax liabilities.

Generally, a foreign irrevocable trust will be treated as a “grantor trust” for taxation purposes regardless of whether the trustmaker reserved any powers associated with domestic grantor trusts. A grantor trust is a trust whose taxable income is reported by the grantor so that the trust is disregarded for U.S. tax purposes. The trustmaker must report all trust income, including capital gains, on their personal tax return as ordinary income. This taxation treatment applies regardless of whether the assets themselves are in the United States or offshore.

In addition, there are IRS reporting requirements for trustees and beneficiaries of offshore trusts. In 1996, Congress imposed substantial penalties for failure to report offshore trust financial information. A trustmaker must work with a CPA experienced with foreign trust reporting and taxation.

Offshore trust structures must be fully disclosed to the IRS and properly maintained to avoid severe penalties.

Jurisdictional Compliance and U.S. Tax Reporting

U.S. persons who establish or benefit from offshore trusts must comply with detailed IRS reporting requirements. Failure to properly report can result in significant penalties, even if no tax is owed.

The most common required forms include:

- Form 3520 – must be filed by a U.S. grantor or beneficiary receiving distributions from a foreign trust.

- Form 3520-A – must be filed annually by the foreign trust itself if it has a U.S. owner.

- FBAR (FinCEN Form 114) – required if trust assets are held in a foreign financial account that exceeds $10,000 in value at any time during the year.

- FATCA (Form 8938) – applies to individuals holding certain foreign financial assets above specific thresholds.

In addition, some offshore jurisdictions now participate in global information-sharing agreements and tax treaties. While the Cook Islands and similar jurisdictions do not currently share trust information with the IRS automatically, compliance laws can evolve.

Investment Powers and Trust Instrument Clauses

The authority of a trustee to manage trust assets depends on the powers granted in the trust instrument. Offshore trust deeds can be written to give the trustee broad or narrow investment discretion, depending on the client’s goals.

Some clients prefer maximum protection with trustee independence, while others want the flexibility to retain influence through mechanisms like a trust protector. Common clauses in the trust deed include:

- Investment authority for the trustee (e.g., discretion to hold, buy, or sell investments)

- Restrictions on certain asset types (such as cryptocurrency or real estate)

- Authorization to form or manage subsidiary LLCs

- Powers to decant or amend the trust under specified conditions

- Direction clauses allowing a protector or committee to veto trustee decisions

We specialize in offshore asset protection.

We’ve advised thousands of clients nationwide on how to protect their assets from creditors. Schedule a phone or Zoom consultation to get started.

Offshore Trusts and Bankruptcy

Debtors may have more success with an offshore trust plan in state court than in a bankruptcy court. Judgment creditors in state court litigation may be intimidated by offshore asset protection trusts and may not seek collection of assets in the hands of an offshore trustee. State courts lack jurisdiction over offshore trustees, which means that state courts have limited remedies to order compliance with court orders.

An offshore trust does not work as well if the U.S. debtor files bankruptcy. A bankruptcy debtor must surrender all their assets and legal interests in property wherever held to the bankruptcy trustee. Bankruptcy courts have worldwide jurisdiction and are not deterred by foreign countries’ refusal to recognize general civil court orders from the U.S.

A U.S. bankruptcy judge may compel the bankruptcy debtor to do whatever is required to turn over to the bankruptcy trustee all the debtor’s assets throughout the world, including the debtor’s beneficial interest in an offshore trust. Bankruptcy debtors who have refused such orders have been held in contempt and incarcerated.

Frequently Asked Questions About Offshore Trusts

How does an offshore trust work?

An offshore trust transfers legal title of a person’s assets over to a trustee of a trust located outside the United States. Both the assets and the trustee will be outside the jurisdiction of a U.S. civil court. A civil creditor must spend a lot of resources pursuing the offshore trustee—and even then, there is no guarantee of success.

Ultimately, having assets in an offshore trust provides the U.S. debtor with substantial leverage in settling a civil money claim. Offshore trusts do not work as well in bankruptcy proceedings or for liabilities other than monetary judgments.

How much does it cost to set up an offshore trust?

We charge $15,000 to form an offshore trust. Large law firms and trust companies typically charge clients between $20,000 and $30,000. The offshore trustees also charge fees in the range of $3,000 to $5,000. The trustee will also charge annual fees. Customizing the trust, such as having a trust protector, will increase legal fees.

What’s the best place to form an offshore trust?

There are many academic publications and articles discussing the relative merits of various offshore trust jurisdictions. Common offshore trust jurisdictions include the Cook Islands, Nevis, the West Indies, and Hungary. Each of these countries has trust statutes that are favorable for offshore asset protection.

There are subtle legal differences among offshore trust jurisdictions’ laws, but they have more features in common. The trustmaker’s choice of country depends mostly on where the trustmaker feels most comfortable placing assets.

How are offshore trusts taxed?

Tax treatment of foreign offshore trusts is very specialized. You should talk to a CPA experienced with offshore trust taxation to better understand the tax consequences of an offshore trust, especially if the offshore trust will generate income or own a business.

How safe is an offshore trust?

The safety of an offshore trust depends on the choice of jurisdiction, the expertise of the appointed trustee, and strict compliance with home country regulations.

Can I still control my assets in an offshore trust?

Yes, you can retain control through a trusted advisor or protector, but for the trust to be effective, you shouldn’t have direct access. This ensures the assets are legally separate from you.

Are offshore trusts legal?

Yes, offshore trusts are completely legal when properly set up and managed. You must follow U.S. tax laws and disclose the trust to the IRS, but as long as you comply, they’re a legitimate way to protect your assets.

Who should consider an offshore trust?

People with significant assets, business owners, or those facing potential lawsuits may benefit from an offshore trust. It’s ideal for anyone looking to safeguard their wealth and provide financial security for their family.

Sign up for the latest information.

Get regular updates from our blog, where we discuss asset protection techniques and answer common questions.